Home /

Answered Questions /

Other /

required-information-the-following-information-applies-to-the-questions-displayed-below-on-january-1-aw594

(Solved): Required Information [The Following Information Applies To The Questions Displayed Below.] On Januar...

![Required information [The following information applies to the questions displayed below.] On January 1, Mitzu Co. pays a lum](https://media.cheggcdn.com/media/99b/99b45d00-fdb0-4a6b-b6cf-add5d9efae4b/phpxfA2e6.png)

Required information [The following information applies to the questions displayed below.] On January 1, Mitzu Co. pays a lump-sum amount of $2,750,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $678,500, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $472,000 and is expected to last another 16 years with no salvage value. The land is valued at $1,799,500. The company also incurs the following additional costs. $ 344,400 185,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $402,000 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,242,000 173,000

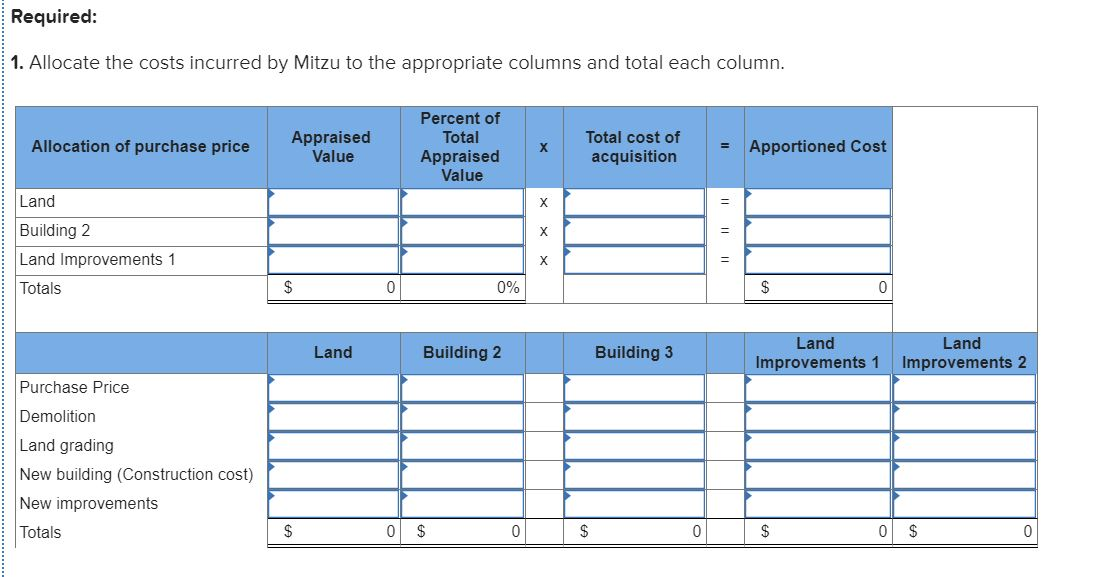

Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Allocation of purchase price Appraised Value Percent of Total Appraised Value Total cost of acquisition = Apportioned Cost Land Building 2 Land Improvements 1 Totals $ 0% 0 Land Building 2 Building 3 Land Improvements 1 Land Improvements 2 Purchase Price Demolition Land grading New building Construction cost) New improvements Totals 0 $ 0 $

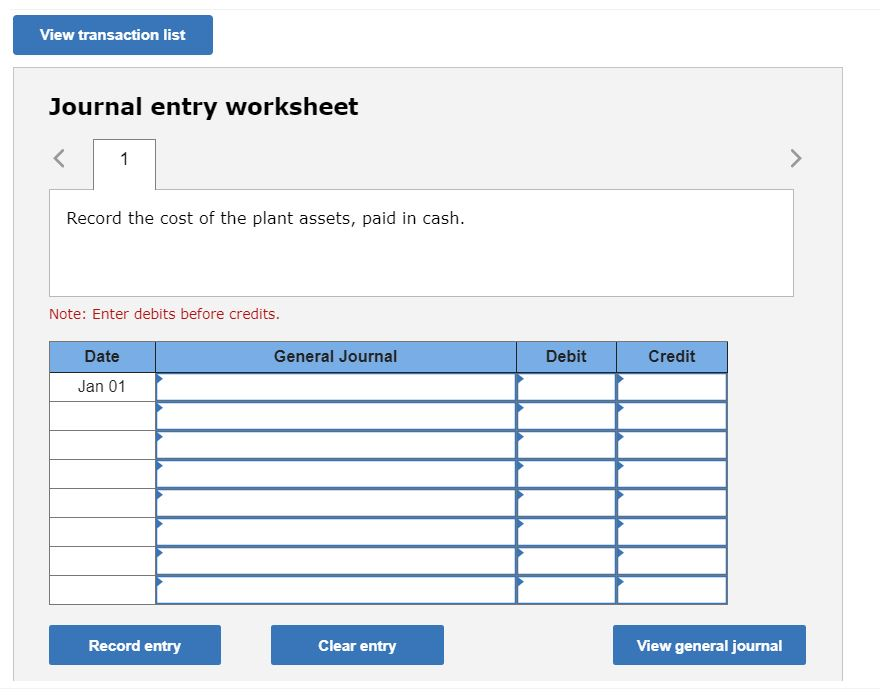

View transaction list Journal entry worksheet Record the cost of the plant assets, paid in cash. Note: Enter debits before credits. General Journal Debit Credit Date Jan 01 Record entry Clear entry View general journal

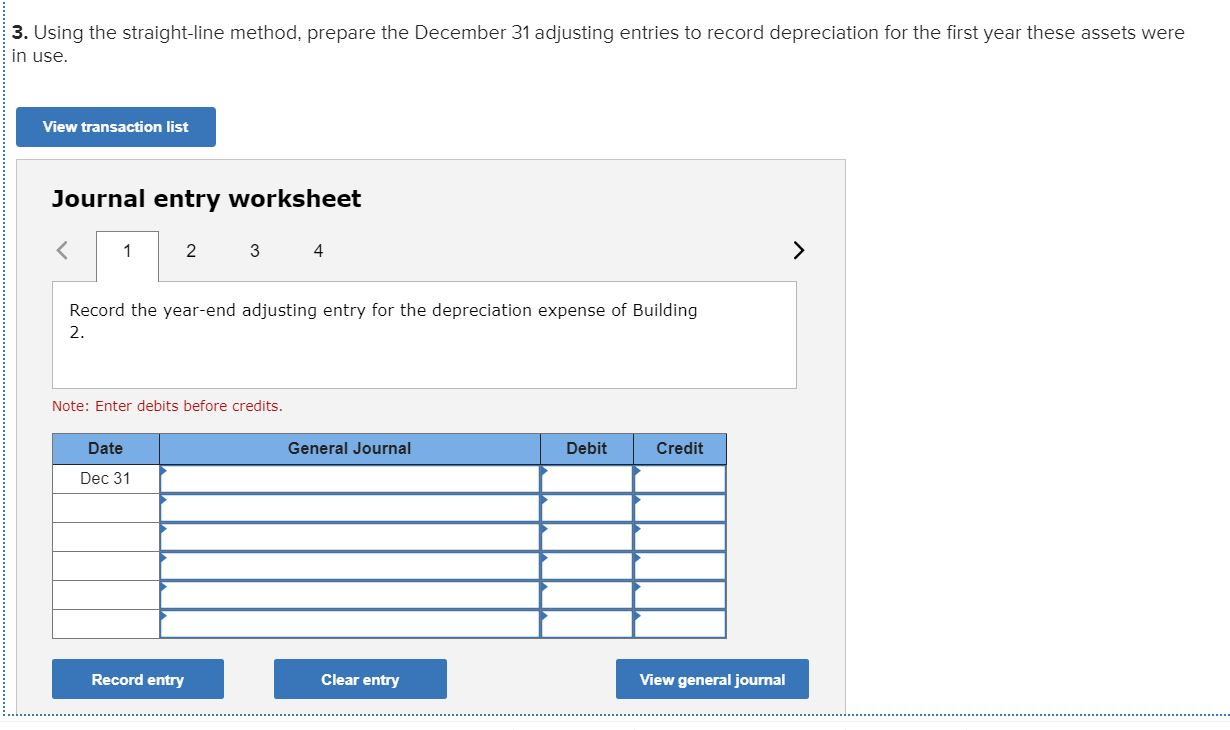

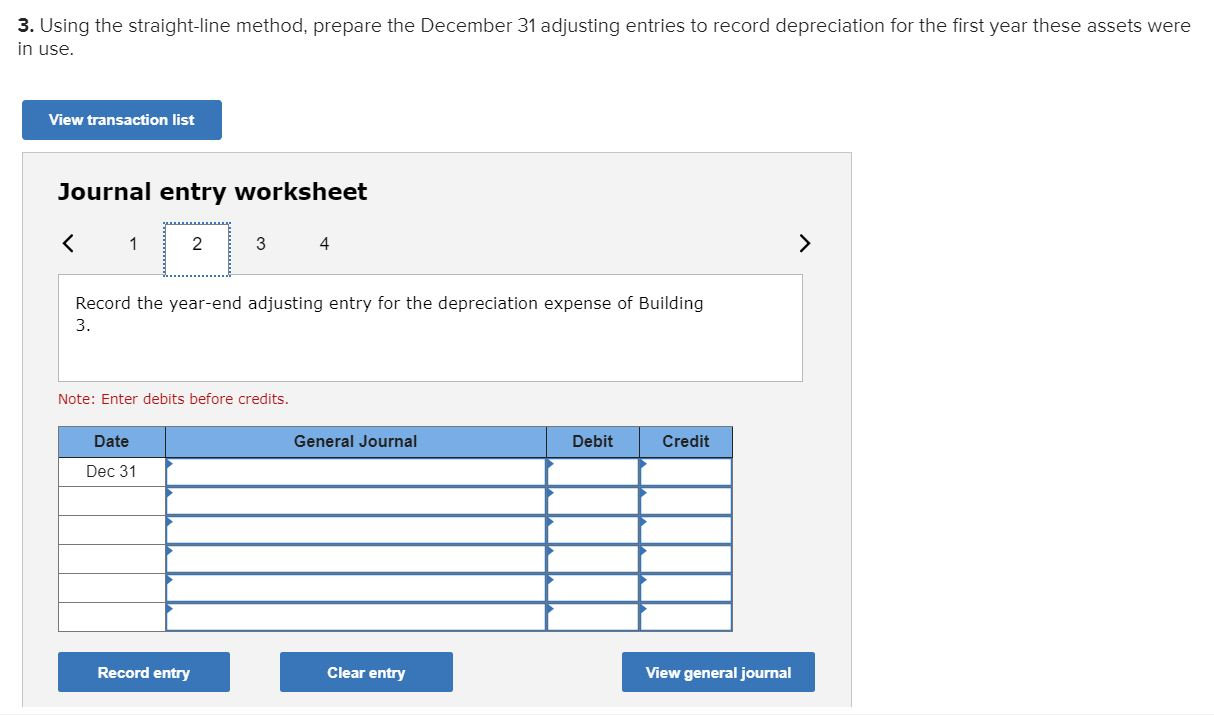

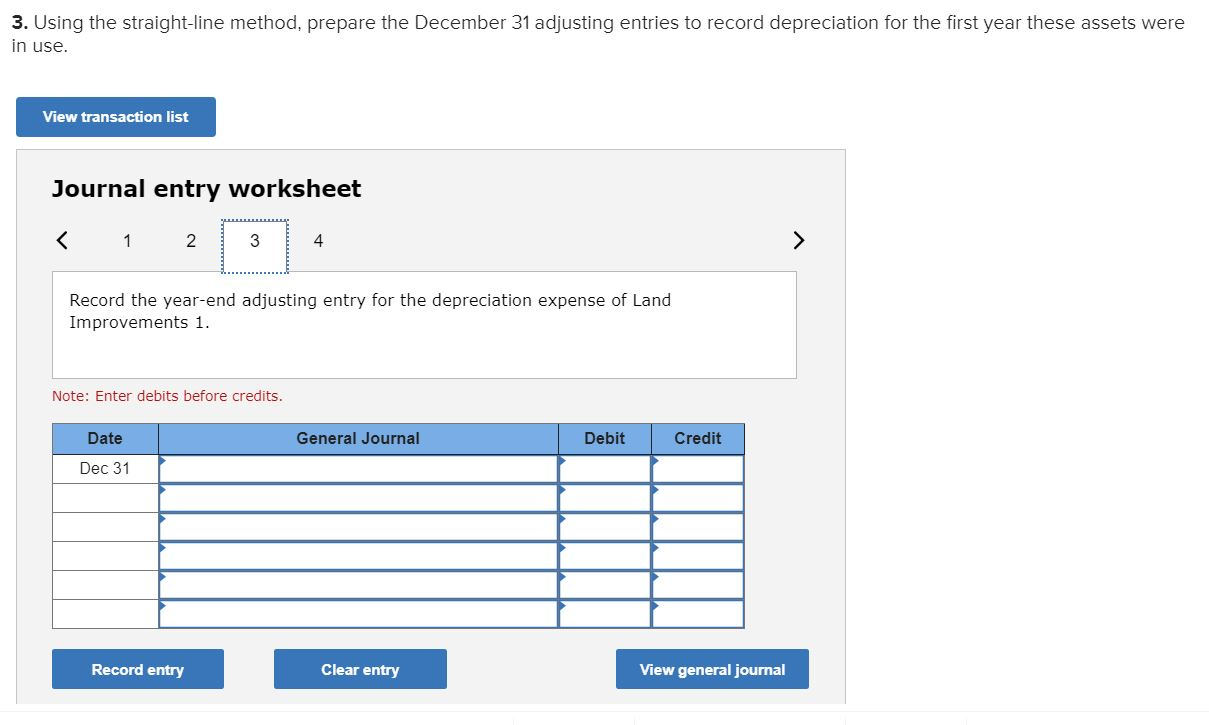

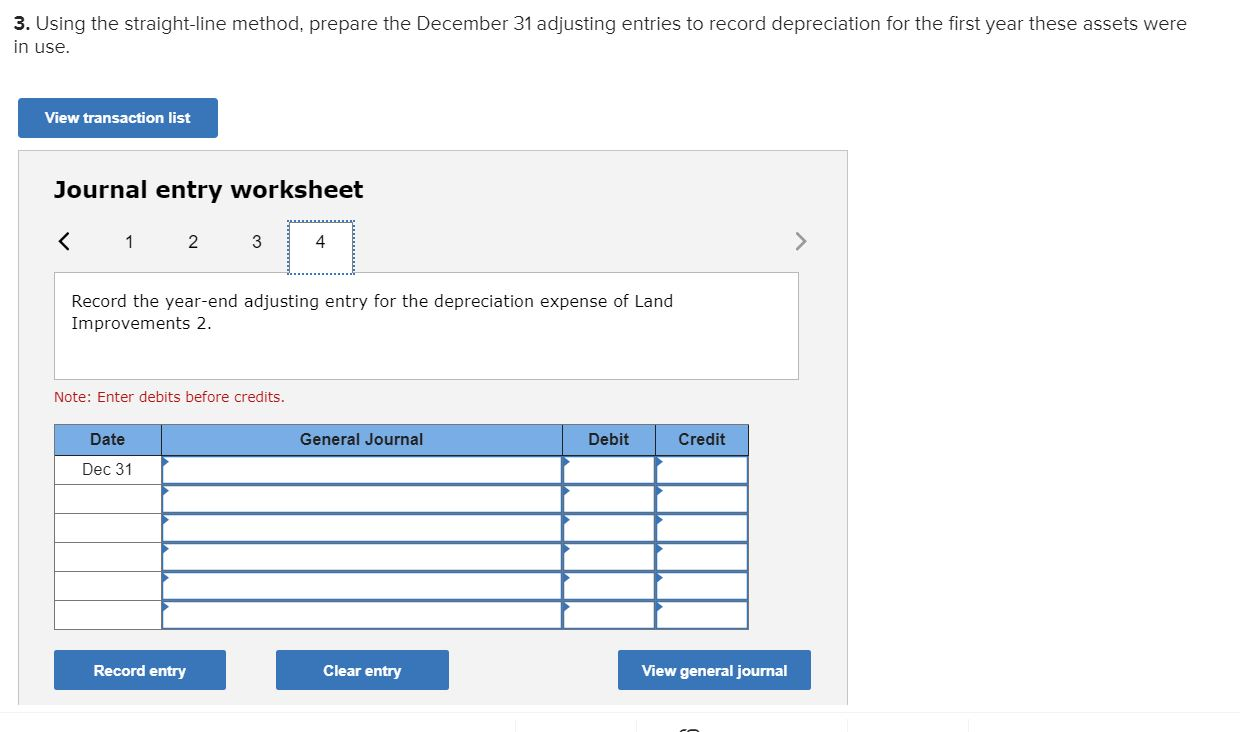

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet 2 3 4 Record the year-end adjusting entry for the depreciation expense of Building Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet < 1 2 Record the year-end adjusting entry for the depreciation expense of Land Improvements 1. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet < 1 2 3 Record the year-end adjusting entry for the depreciation expense of Land Improvements 2. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31 Å¿ Record entry Clear entry View general journal

We have an Answer from Expert

View Expert Answer

Expert Answer

In the first step taking Apprised values as base Total lumpsum amount of $ 27,50,000 has been apportioned between the assets purchased as below: (Amount in $) 1. Allocation of cost inc

We have an Answer from Expert

Buy This Answer $6

Buy This Answer $6

-- OR --

Subscribe To View Unlimited Answers

Subscribe $20 / Month

Subscribe $20 / Month