Home /

Answered Questions /

Other /

on-january-1-2019-kelly-corporation-acquired-bonds-with-a-face-value-of-500-000-for-484-163-65-a-pri-aw989

(Solved): On January 1, 2019, Kelly Corporation Acquired Bonds With A Face Value Of $500,000 For $484,163.65, ...

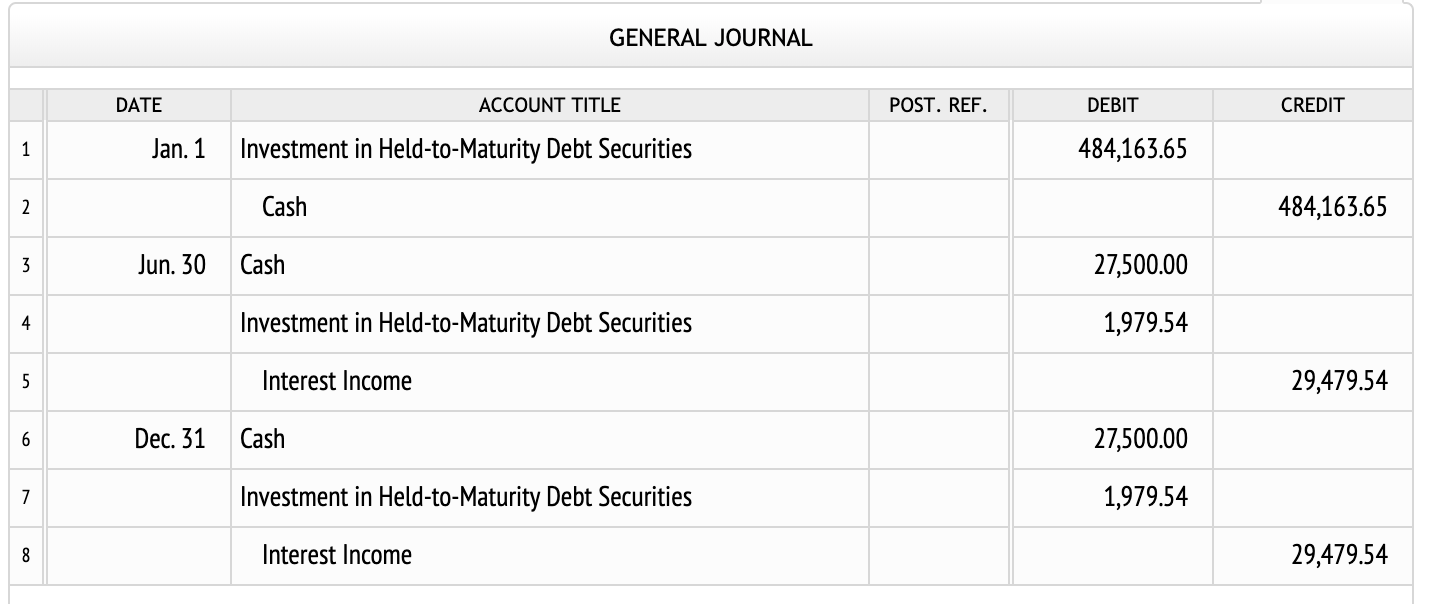

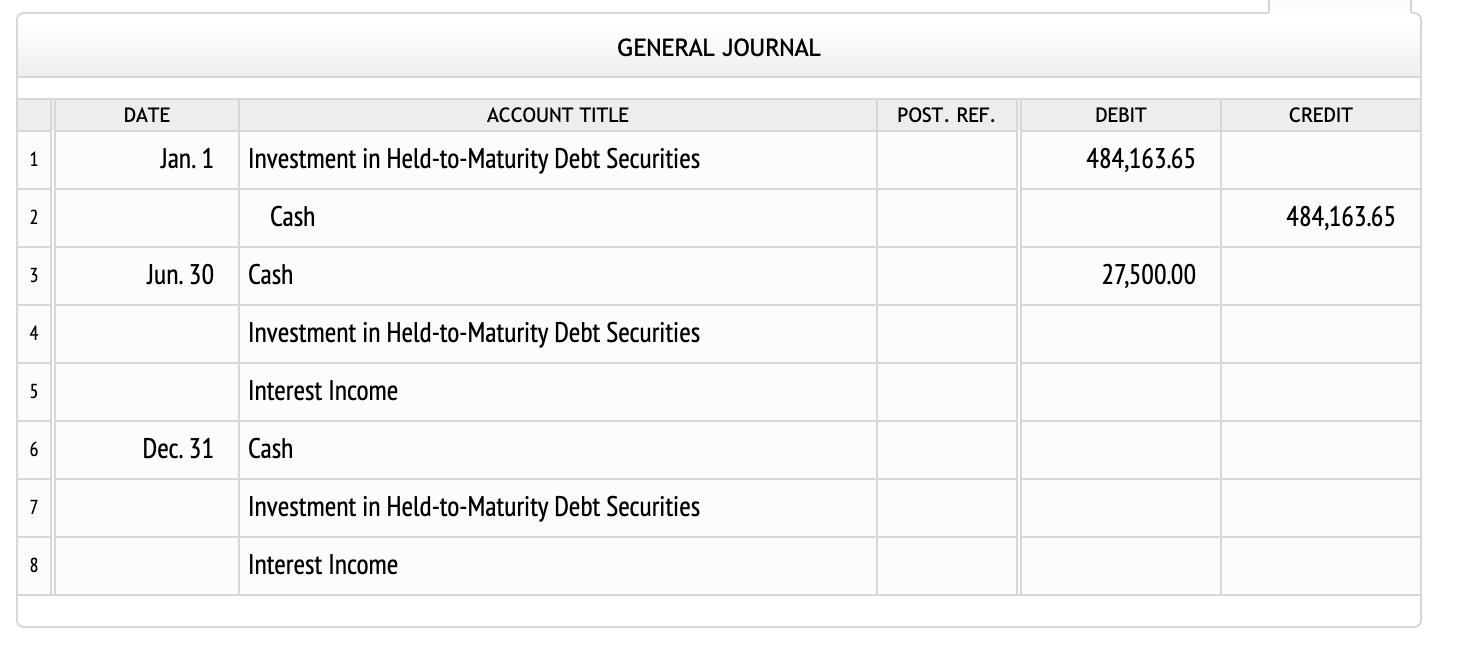

On January 1, 2019, Kelly Corporation acquired bonds with a face value of $500,000 for $484,163.65, a price that yields a 11% effective annual interest rate. The bonds carry a 10% stated rate of interest, pay interest semiannually on June 30 and December 31, are due December 31, 2022, and are being held to maturity.

Required:

| Prepare journal entries to record the purchase of the bonds and the first two interest receipts using the: |

| 1. | straight-line method of amortization |

| 2. |

effective interest method of amortization |

1.

2.

GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Jan. 1 Investment in Held-to-Maturity Debt Securities 484,163.65 Cash 484,163.65 Jun. 30 Cash 27,500.00 Investment in Held-to-Maturity Debt Securities 1,979.54 Interest Income 29,479.54 Dec. 31 Cash 27,500.00 Investment in Held-to-Maturity Debt Securities 1,979.54 Interest Income 29,479.54

GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT Jan. 1 Investment in Held-to-Maturity Debt Securities 484,163.65 Cash 484,163.65 Jun. 30 Cash 27,500.00 Investment in Held-to-Maturity Debt Securities Interest Income Dec. 31 Cash Investment in Held-to-Maturity Debt Securities Interest Income

We have an Answer from Expert

View Expert Answer

Expert Answer

We have an Answer from Expert

Buy This Answer $6

Buy This Answer $6

-- OR --

Subscribe To View Unlimited Answers

Subscribe $20 / Month

Subscribe $20 / Month