Home /

Answered Questions /

Other /

assume-that-a-3-year-treasury-note-has-no-maturity-premium-and-that-the-real-risk-free-rate-of-inter-aw456

(Solved): Assume That A 3-year Treasury Note Has No Maturity Premium, And That The Real, Risk-free Rate Of Int...

please show work in written form (not excel) thank you.

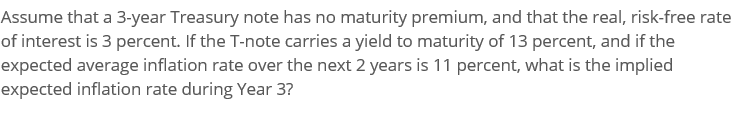

Assume that a 3-year Treasury note has no maturity premium, and that the real, risk-free rate of interest is 3 percent. If the T-note carries a yield to maturity of 13 percent, and if the expected average inflation rate over the next 2 years is 11 percent, what is the implied expected inflation rate during Year 3?

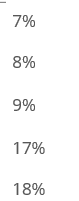

7% 8% 9% 17% 18%

We have an Answer from Expert

View Expert Answer

Expert Answer

Answer - 8% Given real risk free rate = Rf = 3%, 3-year YTM = nominal rate = 13% Average Inflation over next 2 years = 11% Calculating, Average nominal rate over next 2 years = Average

We have an Answer from Expert

Buy This Answer $6

Buy This Answer $6

-- OR --

Subscribe To View Unlimited Answers

Subscribe $20 / Month

Subscribe $20 / Month