Home /

Answered Questions /

Other /

an-insurance-company-must-make-payments-to-a-customer-of-10-million-in-5-years-and-25-million-in-30--aw562

(Solved): An Insurance Company Must Make Payments To A Customer Of $10 Million In 5 Years And $25 Million In 3...

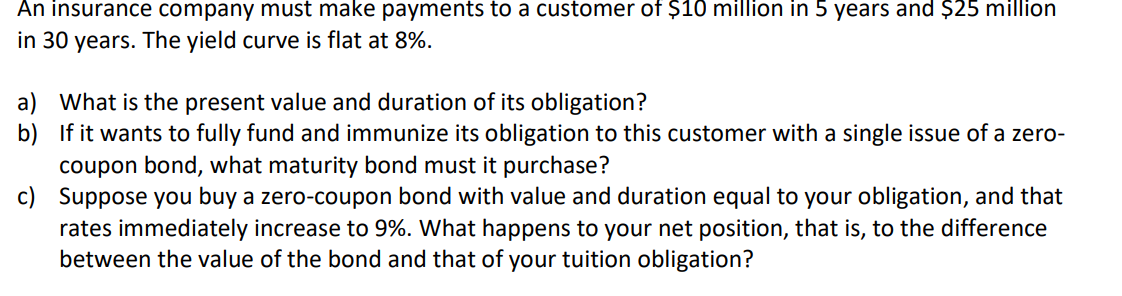

An insurance company must make payments to a customer of $10 million in 5 years and $25 million in 30 years. The yield curve is flat at 8%. a) What is the present value and duration of its obligation? b) If it wants to fully fund and immunize its obligation to this customer with a single issue of a zero- coupon bond, what maturity bond must it purchase? Suppose you buy a zero-coupon bond with value and duration equal to your obligation, and that rates immediately increase to 9%. What happens to your net position, that is, to the difference between the value of the bond and that of your tuition obligation?

We have an Answer from Expert

View Expert Answer

Expert Answer

Please see the table below. Please be guided by the second rowto understand the mathematics.Figures in parenthesis, if any, mean negative values. All financials are in $ million. Liabilities Term

We have an Answer from Expert

Buy This Answer $6

Buy This Answer $6

-- OR --

Subscribe To View Unlimited Answers

Subscribe $20 / Month

Subscribe $20 / Month