Home /

Answered Questions /

Other /

sweet-corp-sponsors-a-defined-benet-pension-plan-for-its-employees-on-january-1-2020-the-following-b-aw511

(Solved): Sweet Corp. Sponsors A Defined Benet Pension Plan For Its Employees. On January 1, 2020, The Followi...

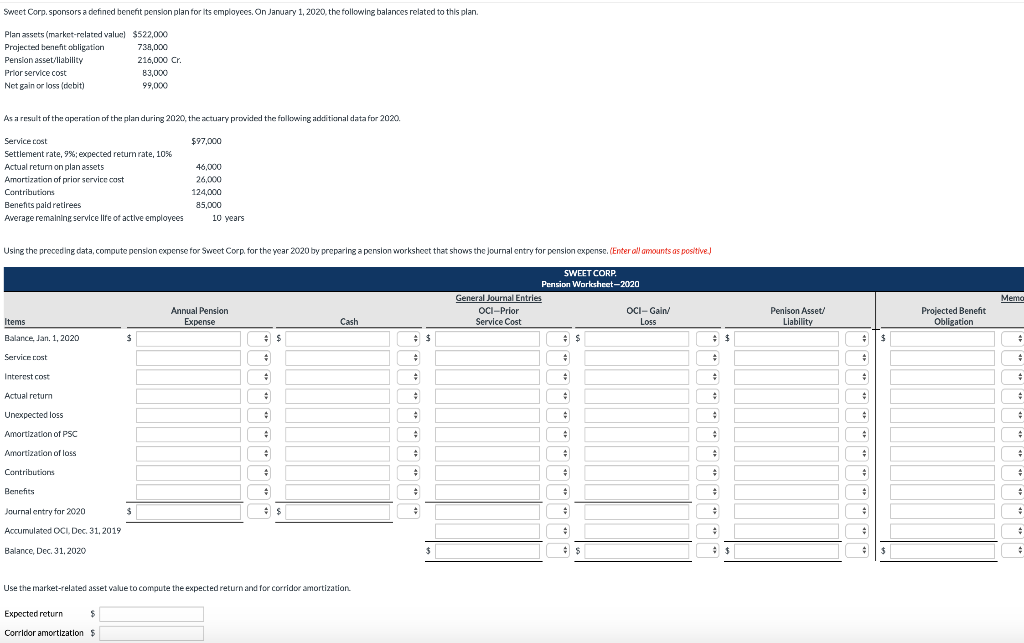

Sweet Corp. sponsors a defined benet pension plan for its employees. On January 1, 2020, the following balances related to this plan Plan assets (market-related value Prajected benefit obligation Pension asset/liability Prior service cost Nct gain or loss (dcbit) $522,000 738,000 216,000 Cr. 83,000 99,000 As a result of the aperation of the plan during 2020, the actuary provided the following additional data for 2020 $97,000 Service cost Settlement rate, 9%, expected retumrate, 10% Actual return on plan assets Amortization of prior service cost Contributions Benefits pald retirees Average remaining service life of active employees 46,000 26,000 124,000 85,000 10 years Using the preceding data, compute pension expense for Sweet Corp. for the year 2020 by preparing a pension worksheet that shows the journal entry for pension expense. (Enter all amounts as positive! SWEET CORP. Pension Worksheet-2020 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Memo Annual Pension Expense Penison Asset/ Liability Projected Benefit Obligation Items Balance, Jan, 1.2020 Service cost Interest cost Actual return Unexpected loss Amortization of PSC .......... Amortization of loss Contributions Benefits Journal entry for 2020 Accumulated OCI, Dec 31, 2019 Balance, Dec 31, 2020 Use the market-related asset value to compute the expected return and for corridor amortization Expected return Corridor amortization $

We have an Answer from Expert

View Expert Answer

Expert Answer

We have an Answer from Expert

Buy This Answer $6

Buy This Answer $6

-- OR --

Subscribe To View Unlimited Answers

Subscribe $20 / Month

Subscribe $20 / Month