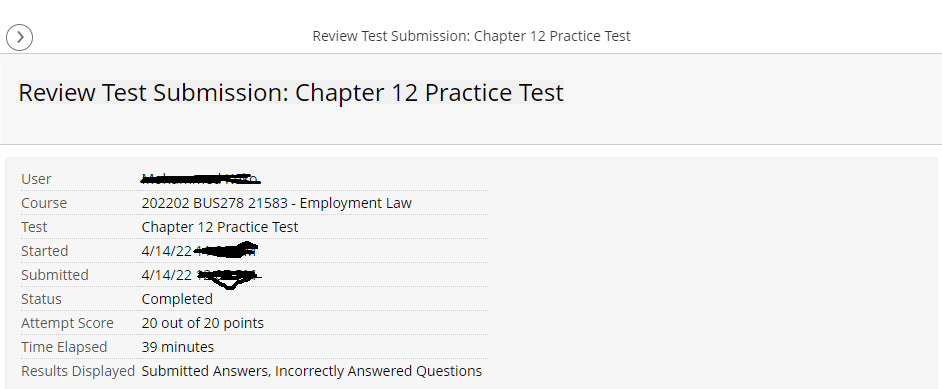

(Solved): 202202 BUS278 21583 - Employment Law Chapter 12 Practice Test Attempt 20 out of 20 points...

202202 BUS278 21583 - Employment Law

Chapter 12 Practice Test

Attempt 20 out of 20 points

QUESTION 1

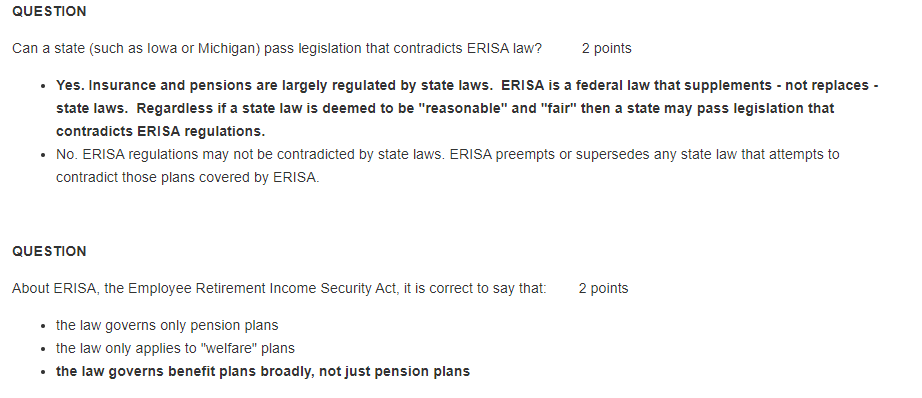

Can a state (such as Iowa or Michigan) pass legislation that contradicts ERISA law? 2 points

- Yes. Insurance and pensions are largely regulated by state laws. ERISA is a federal law that supplements - not replaces - state laws. Regardless if a state law is deemed to be "reasonable" and "fair" then a state may pass legislation that contradicts ERISA regulations.

- No. ERISA regulations may not be contradicted by state laws. ERISA preempts or supersedes any state law that attempts to contradict those plans covered by ERISA.

QUESTION 2

Which of the following is a qualifying event necessitating an offer of COBRA continuation coverage? 2 points

- an employee is reprimanded

- an employee leaves on vacation

- an employee adopts a child

- an employee quits his job

QUESTION 3

About ERISA, the Employee Retirement Income Security Act, it is correct to say that: 2 points

- the law governs only pension plans

- the law only applies to "welfare" plans

- the law governs benefit plans broadly, not just pension plans

QUESTION 4

An employee whose wife suffered from breast cancer was terminated after a change of ownership of the company. He asked whether their health insurance would continue, and was told verbally that it would. Nine months later when his wife sought treatment, she was advised the policy had been terminated. He and his wife sued for a violation of COBRA. The court should rule: ? 2 points

- ?for the employer, since the employee never requested in writing that their insurance be continued

- ?for the employee, since he was not given notice of his COBRA rights in writing

- ?for the employee’s wife, because she was also an insured, but was given no notice of her COBRA rights

- ?for the employer, since it was a new owner, and not the employer of the employee.

QUESTION 5

The Affordable Care Act ("ObamaCare") was written so that the basic strategy for expanding health care coverage was to increase enrollment in

- Medicare.

- Medicaid.

- Social Security

- All the above are correct answers.

QUESTION 6

Defined benefit pension plans: 2 points

- promise a specific pension benefit upon retirement

- are not insured through the Pension Benefit Guaranty Corporation (PBGC)

- are less regulated pension plans

- require a specific contribution each pay period

QUESTION 7

Under ObamaCare (Affordable Care Act)

- health care plans are required to cover dependent children up to age 26 years.

- pre-existing conditions exclusions in health plans are prohibited.

- health care plans may not place a lifetime dollar benefit payable to a person.

- All the other answers are correct.

QUESTION 8

In Chapter 12 of the Walsh book (at the very end of the chapter) the author discusses wellness programs. These programs are often used as a way to keep group health insurance costs lower by improving employee health. Which of the below statements is a correct overview of the author's views about such programs? 2 points

- He is a strong advocate of such programs and calls them a win-win situation. He especially likes the fact that such wellness programs are pretty much free of any possible government laws or requirements as they are most always voluntary on the part of employees. In short, the author sees no problems with such programs since better health can only lead to better results for everyone.

- The author appears to take a cautious approach to wellness programs. He states such programs can violate HIPAA and PPACA nondiscrimination requirements since employees may be charged more for their health insurance coverage based on their health factors. He points out that such programs, while certainly well intended, need to be carefully implemented by employers.

QUESTION 9

An employee would likely prefer this kind of pension plan:

- a hybrid plan

- a defined benefit plan

- a defined contribution plan

QUESTION 10

An employee is terminated for poor attendance. The employer sends a letter on May 1 notifying him of his right to receive continuation health insurance coverage. The letter states that the former employee must respond by May 30 to be eligible for up to 6 months of continuation coverage. The employer’s letter:

- should state that the employee has 60 days to decide on coverage that would last up to 18 months

- should state that the employee has 60 days to decide on coverage that would last up to 3 years

- should state that the employee has 45 days to decide on coverage that would last up to 3 years

- accurately states the former employee’s rights under COBRA

QUESTION

Which of the following is a qualifying event necessitating an offer of COBRA continuation coverage? 2 points

- an employee is reprimanded

- an employee leaves on vacation

- an employee adopts a child

- an employee quits his job

QUESTION

The Affordable Care Act ("ObamaCare") was written so that the basic strategy for expanding health care coverage was to increase enrollment in 2 points

- Medicare.

- Medicaid.

- Social Security

- All the above are correct answers.

QUESTION

Which of the following is a qualifying event necessitating an offer of COBRA continuation coverage?

- an employee is reprimanded

- an employee leaves on vacation

- an employee adopts a child

- an employee quits his job

QUESTION

In Chapter 12 of the Walsh book (at the very end of the chapter) the author discusses wellness programs. These programs are often used as a way to keep group health insurance costs lower by improving employee health. Which of the below statements is a correct overview of the author's views about such programs?

- He is a strong advocate of such programs and calls them a win-win situation. He especially likes the fact that such wellness programs are pretty much free of any possible government laws or requirements as they are most always voluntary on the part of employees. In short, the author sees no problems with such programs since better health can only lead to better results for everyone.

- The author appears to take a cautious approach to wellness programs. He states such programs can violate HIPAA and PPACA nondiscrimination requirements since employees may be charged more for their health insurance coverage based on their health factors. He points out that such programs, while certainly well intended, need to be carefully implemented by employers.

QUESTION

Wells Fargo lost the case of Harrison v Wells Fargo Bank (4th Cir 2014) (Pages 465-468 Walsh text). What was the main reason the employer lost this case?

- Wells Fargo did not meet the "full and fair review" requirements imposed by ERISA. In other words, Wells Fargo did not engage in proper review of Nancy Harrison's case or properly obtain the necessary medical records to have a full understanding of her situation / case.

- It was proven that Wells Fargo had a systematic plan to automatically deny any person's claim for benefits until at least the second appeal level. Once a case reached a second appeal then Wells Fargo would come up with a technical reason to deny the claim of most any claimant. Nancy Harrison was just one of many, many employees Wells Fargo had treated this way.

- The U.S. Department of Justice got involved in this case - which it called a scheme - and prosecuted the employer for violating federal ERISA law. The employer was ordered to make full restitution to all the victims of this scheme (including Nancy Harrison).

- All the other answers are correct.

QUESTION

In Chapter 12 of the Walsh book (at the very end of the chapter) the author discusses wellness programs. These programs are often used as a way to keep group health insurance costs lower by improving employee health. Which of the below statements is a correct overview of the author's views about such programs?

- He is a strong advocate of such programs and calls them a win-win situation. He especially likes the fact that such wellness programs are pretty much free of any possible government laws or requirements as they are most always voluntary on the part of employees. In short, the author sees no problems with such programs since better health can only lead to better results for everyone.

- The author appears to take a cautious approach to wellness programs. He states such programs can violate HIPAA and PPACA nondiscrimination requirements since employees may be charged more for their health insurance coverage based on their health factors. He points out that such programs, while certainly well intended, need to be carefully implemented by employers.

Expert Answer

Buy This Answer $10

-- OR --

Subscribe $20 / Month